- Tax act captcha software free download for free#

- Tax act captcha software free download software#

- Tax act captcha software free download trial#

- Tax act captcha software free download series#

Not sure you want to do your taxes yourself? Go back to E-file Options. You'll need your SSN or Individual Taxpayer Identification Number, filing status and the exact whole dollar amount of your refund. Go to Where's My Refund? on the right side of the IRS.gov homepage to find out where your refund is in our return processing pipeline.

Tax act captcha software free download for free#

Tax act captcha software free download series#

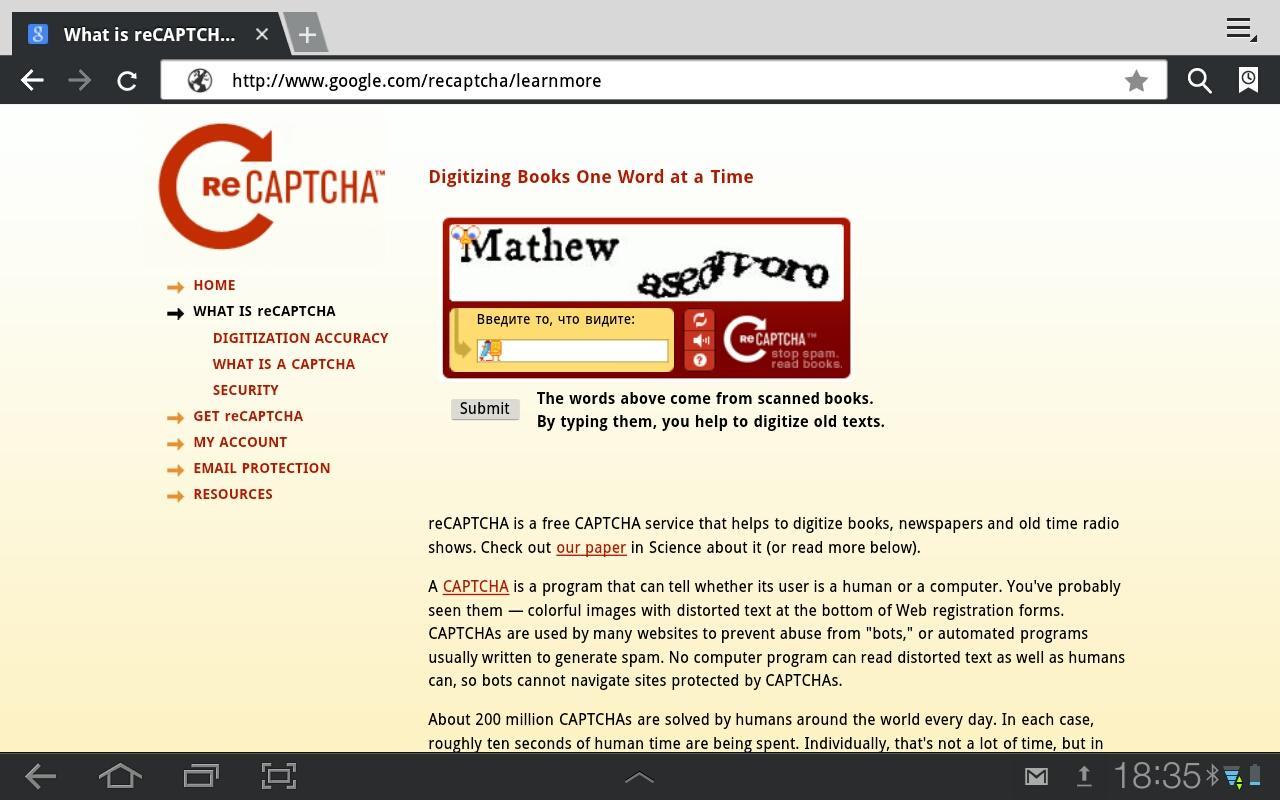

With e-file, you can file as soon as you're ready but schedule your payment for any date up until your due date. Forms in the 1040 series are due in April for most taxpayers, but other forms have different due dates. This saves time and prevents a simple mistake from holding up your refund. If we find easy-to-fix mistakes, like a math error or an incorrect Social Security number, we immediately send it back to you. It is not sent by email because email is not as safe as our secure channels.Īs part of the delivery process, IRS computers automatically check your return for mistakes. When you file your return, it will be securely transmitted through an IRS-approved electronic channel. Millions of people have trusted our service to file their taxes for free, and customers rated it 4.8 out of 5 stars. You can sign using the Self-Select PIN or by using your prior-year Adjusted Gross Income. Cash App Taxes (formerly Credit Karma Tax) is a fast, easy, 100 free way to file your federal and state taxes. You must sign your e-filed return electronically.

Tax act captcha software free download software#

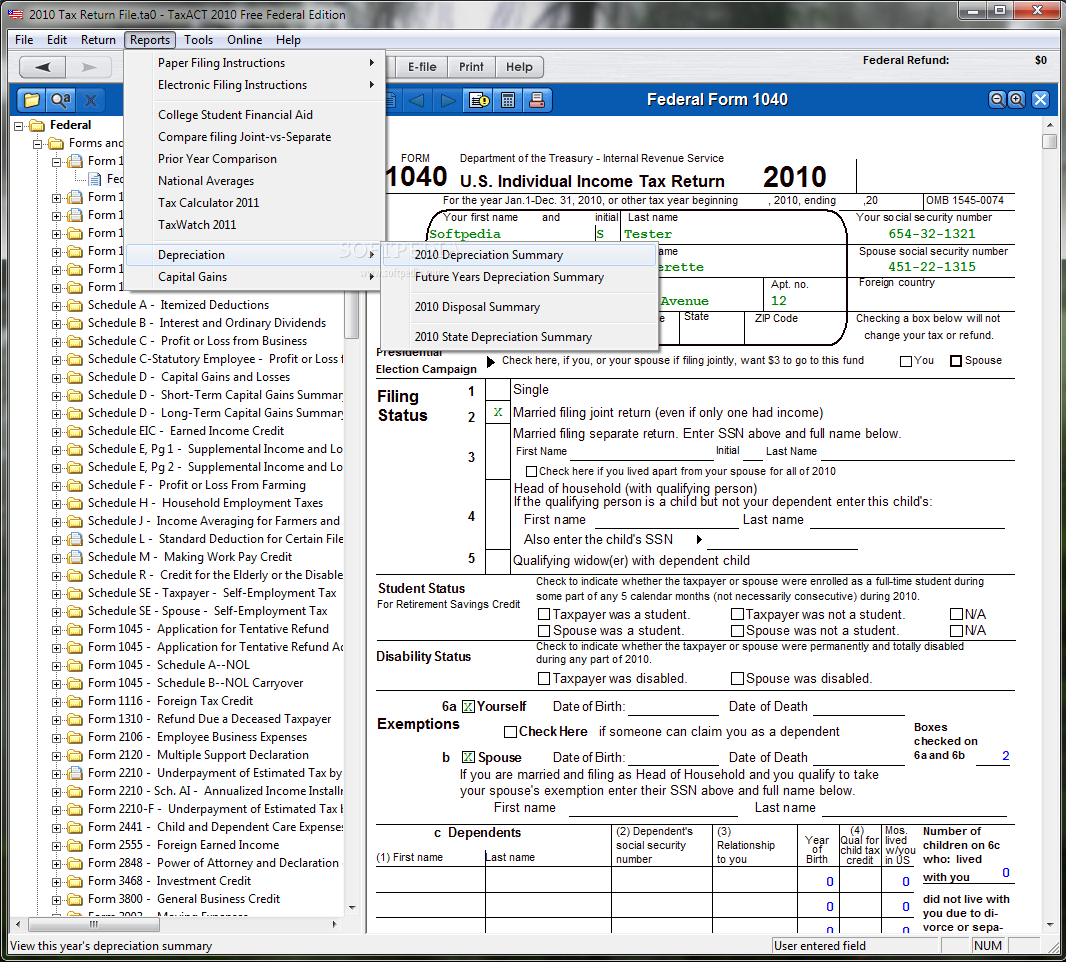

The software uses a question and answer format that makes doing taxes easier. Gather your tax information and get commercial tax prep software.

In the event that a software vendor fails to meet federal and state requirements, the Department will remove them from this list.You can use commercial tax prep software and file your taxes electronically. The Department is not affiliated with any software companies, does not endorse any products, and is not responsible for software vendors’ products or errors that may occur in them. The Department provides this list of software vendors offering electronic filing solutions. 16A See rule 31(1)(b) Certificate under section 203 of the Income-tax Act, 1961 for tax deducted at source Certificate No. The Department does not provide technical support for software products. Certificate under section 203 of the Income-tax Act, 1961 for tax deducted at source. Please contact the customer support for the software product you’re using. Served active duty military in 2021 with Adjusted Gross Income of $73,000 or less.This non-profit, public-private partnership is dedicated to helping millions of people prepare and file their federal taxes online for free. Adjusted Gross Income of $41,000 or less, or The online tax preparation software partners are part of the Free File Alliance, which coordinates with the IRS to provide free electronic federal tax preparation and filing to you.15 less claim based on comparison with TurboTax federal. TaxAct Costs Less: 20 less or File for less claim based on comparison with TurboTax federal pricing for paid consumer online 1040 filing products on. Deluxe is great for maximizing your deductions, as it’ll meticulously check over 350 deductions and credits to make sure you get the maximum refund. TaxAct guarantees you are completely satisfied with your TaxAct software purchase. For a taxpayer to be eligible to use our free services, they will need to meet the following requirements: Deluxe, the company’s most popular tax software product, is priced at 59.99, although that does not include State taxes they’ll set you back a further 44.99. Active Military with Adjusted Gross Income of $73,000 or lessįree Free electronic preparation and filing services for both Federal and Iowa tax returns to eligible Iowa taxpayers.

Eligible for Earned Income Tax Credit, or.

10 active hours of the software is absolutely free.

Tax act captcha software free download trial#

0 kommentar(er)

0 kommentar(er)